China’s latest retail numbers have exceeded expectations while industrial production figures came in below estimates, flipping the expectation script from the previous month as well as simultaneously highlighting the obstacles of navigating trade tensions with the US.

May’s retail sales rose 6.4 percent, up from 5.1 percent in the prior month, according to a report released by the National Bureau of Statistics on Monday. Sales increased at the fastest pace since December 2023, with year-to-date spending up 5.0 percent as the effects of the trade-in programme continued to materialise.

[See more: China says it will drop tariffs on almost all African imports]

Industrial production meanwhile slumped to its slowest pace this year at 5.8 percent, coming in below April’s 6.1 percent. The total value added by industrial enterprises grew 5.8 percent, while the value added by equipment manufacturing rose 9.0 percent. The data follows May’s 49.5 PMI reading, which although came below the 50 mark threshold to indicate expansionary activity, signalled an improvement from April’s 49.0.

Front-loaded activity still visible

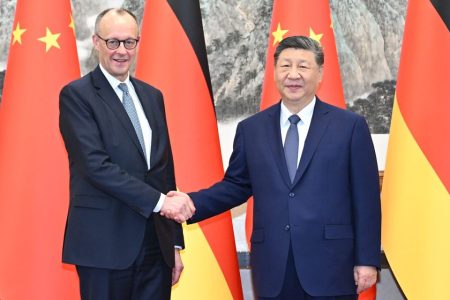

The data presents itself as a mixed picture, as erratic tariff visibility continues to weigh on the global economic outlook. The mid-May reprieve between China and the US was warmly received after Washington’s “reciprocal tariffs” in April stunned global policymakers. However, accusations that neither Washington nor Beijing were honouring their agreed-upon commitments only subsided after their mid-June meeting restored the fragile détente and preserved the earlier truce, reflecting the pace at which the pendulum of tariff uncertainty shifts.

Front-loaded orders accelerated May’s data, according to a report by Morgan Stanley, which anticipates slower growth in the second half of the year, as additional levies are unlikely to help any current momentum.

[See more: Hit by rising costs, US retailers are demanding that Chinese firms pay for shipping]

The US investment bank noted that the beat in China’s retail sales was partly driven by the combined effects of trade-in subsidies and the calendar shift of an earlier summer promotion, pointing out that sales figures outside the trade-in programme remain soft.

Data released on Monday also showed that year to date fixed asset investment was 3.7 percent higher.