China’s purchasing managers index (PMI) of 49.5 in May was better than April’s 49.0 reading, coming as a mid-month tariff reprieve reached between Washington and Beijing in Geneva signalled an initial sign of easing tensions between the world’s largest economies.

While triple-digit tariffs have been put on hold for 90-days, the uncertainty over any lasting impact has yet to renew business confidence, according to analysts, who say that activity is still driven by front-loaded production and shipments to the US during the tariff pause.

Sub-index groups can be seen mirroring the topline PMI trend, with several categories better in May though still contracting. New orders rose to 49.8, compared with 49.2 in the previous month. The new export reading jumped to 47.5 from 44.7.

[See more: Top EU and Chinese semiconductor manufacturers meet in Beijing]

Despite the rebound in new orders, the level remains below the first quarter average, note Morgan Stanley analysts, suggesting that the 30 percent U.S. tariff hikes are still weighing down China’s aggregate demand and exacerbating the prevailing excess capacity issues. The investment bank expects growth to soften in the second half, due in part to a payback from exports that were pulled forward, alongside a pushback in fiscal stimulus worth between 500 billion yuan to 1 trillion yuan sometime in the fourth quarter.

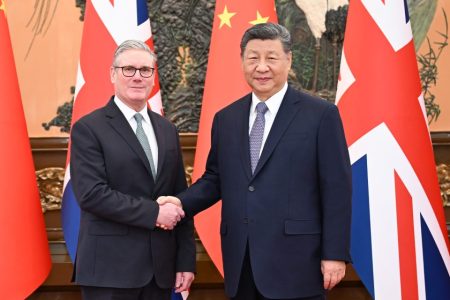

The fragility of the current trade truce is being tested again as Washington and Beijing have each accused each other of violating terms of the current 90-day tariff pause. Major Asian markets fell on the first trading day of June amid worries that slower negotiations would extend lingering economic risks.

Stocks staged a rally after the U.S. Court of International Trade ruled that President Trump lacked the appropriate authority to implement his reciprocal tariffs. The recovery proved short-lived, as a federal appeals court temporarily reinstated them pending further review.