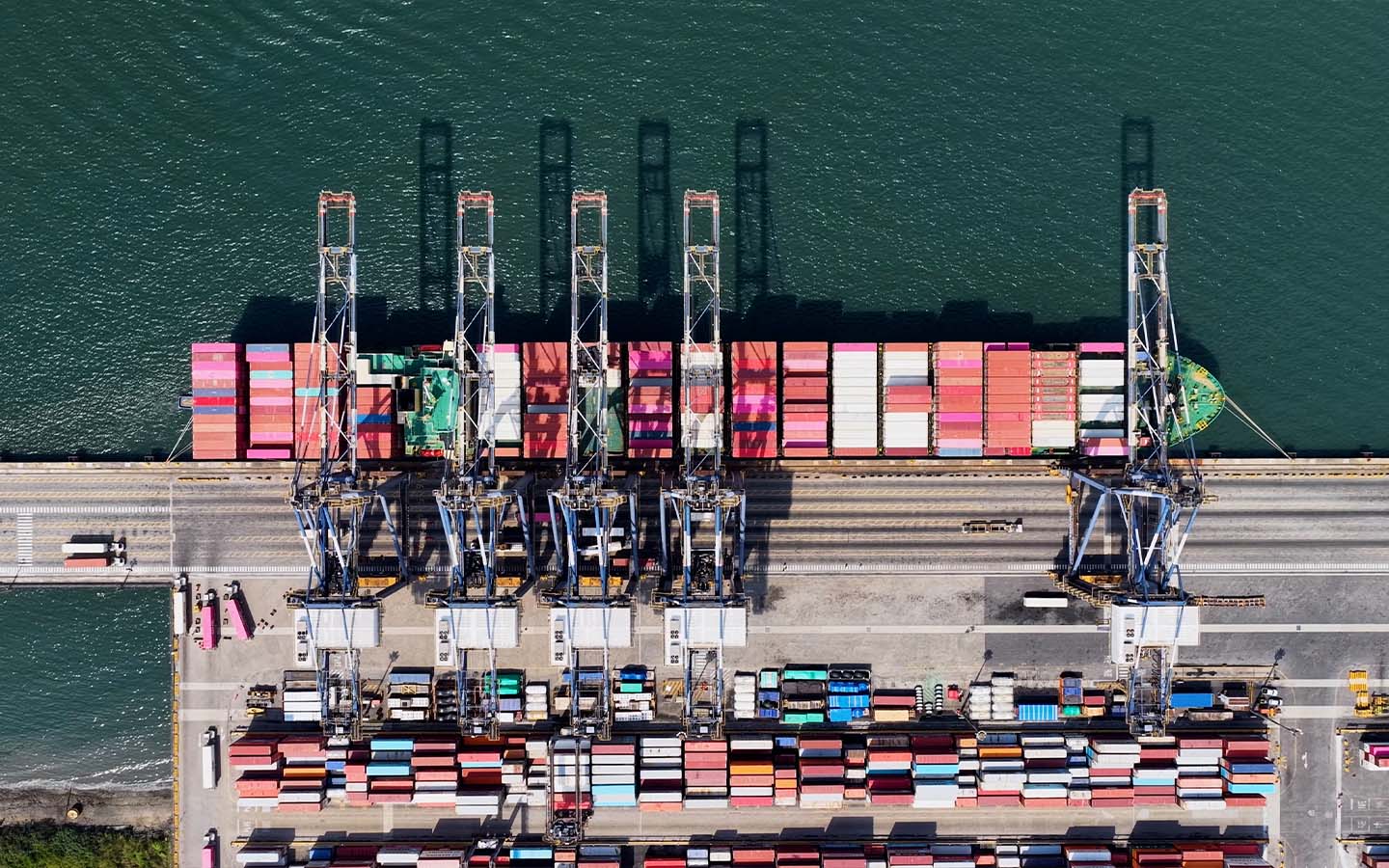

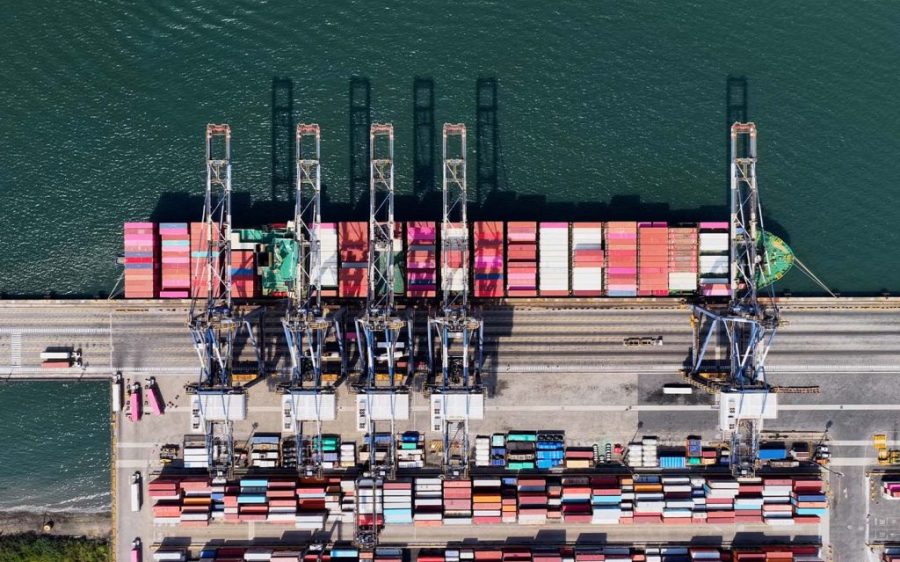

Total bilateral trade between Brazil and China set a new record in 2025, reaching US$171 billion, reports the Global Times.

Last year marked the highest value since records began in 1997, according to data released Thursday by the Brazil-China Business Council (CEBC), up 8.2 percent from 2024. Brazilian exports to China hit their second-highest value in 2025, reaching US$100 billion, driven in large part by soybeans. Sales of the staple crop posted a 10-percent annual increase, accounting for just over a third of total shipments.

The increase came in part due to China cutting off shipments from the US, historically its second-largest supplier, in response to Washington’s aggressive trade war. Brazil also felt the burn, with steep tariff hikes in July and general uncertainty making for “a very complicated year for Brazil-US trade relations,” Tulio Cariello, content director at CEBC, told the Global Times.

Coreillo said that while some redirection of exports occurred, it was limited by differences in consumption habits between China and the US. “They are markets that have little to do with each other,” he explained.

[See more: China posts ‘hard-won’ record trade surplus in 2025]

Brazilian purchases from China meanwhile jumped 11.5 percent to US$70.9 billion, fuelled by the acquisition of an oil exploration platform vessel, electric and hybrid vehicles, fertilizers and chemical products. China also came in as the country’s fourth-largest supplier of medicines and pharmaceutical inputs thanks to a sharp increase last year.

Overall, China accounted for more than a quarter (27.2%) of Brazil’s total trade flow last year, which hit US$629 billion, up 4.9 percent over 2024. Trade between the two countries was more than double Brazil’s exchanges with the US, its second-largest partner, and the Asian giant remained the top destination for Brazilian exports despite significant growth in purchases by Argentina (31.4%) and India (30.2%).

“The axis of Brazilian foreign trade today is increasingly shifting toward Asia,” Cariello told the Global Times, citing the expansion of the middle class and rising food demand in Southeast Asia as key drivers of this trend in the coming year.