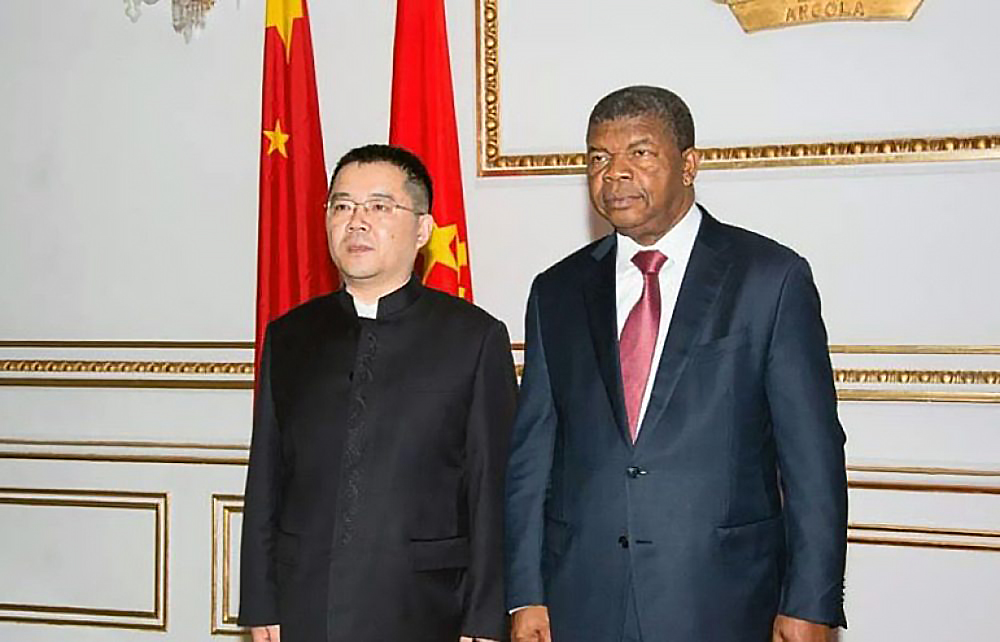

Chinese banks have granted Angola an extension of the debt service moratorium, Gong Tao, the Chinese ambassador to Luanda, has said.

Ambassador Gong Tao said that the main Chinese financial institutions, such as China Development Bank, Commercial and Industrial Bank of China, Bank of China and Export-Import Bank of China (Eximbank), have been “reacting in a very active way”, making concrete efforts regarding the service of the Angolan debt, offering solutions such as moratoriums.

“Last year, the main Chinese creditors were able to maintain dialogue and negotiations with the Angolan authorities to reach a moratorium agreement on debt service,” he stressed, without mentioning figures.

“As far as I know, for the current year, according to the agreements reached in the framework of the Debt Service Suspension Initiative (DSSI), Eximbank is still holding negotiations with the Angolan side for an agreement on a new moratorium package.

“As a member of the G20 and main creditor of some African countries, China attaches great importance to the work of implementing the DSSI and was the first country to participate in and support the extension of the debt service moratorium period.”

According to National Bank of Angola data, bilateral debt stood at the end of 2020 at US$5.8 billion, CLBrief reported.

Last year, the Angolan Finance Minister, Vera Daves, announced that the renegotiation of the Angolan debt, inside and outside the G20, would save US$6 billion by 2023.