The Greater Bay Area (GBA) ranks third nationwide for the number of “pre-unicorn” tech start-ups it hosts, according to a new report published by the China Center for Information Industry Development Technology Innovation and reported by Yicai Global.

The report identified 100 high-growth Chinese tech companies with valuations under US$1 billion but strong potential to reach unicorn status within three to five years. Of these, 59 were based in the Yangtze River Delta – by far the largest share – followed by 17 in the Beijing–Tianjin–Hebei region, and just 14 in the GBA.

That the GBA lags behind the country’s northern and eastern urban clusters in nurturing the next generation of billion-dollar startups could be considered surprising, given Shenzhen’s reputation as the country’s preeminent tech hub.

[See more: The Greater Bay Area’s first international business talent centre opens in Shenzhen]

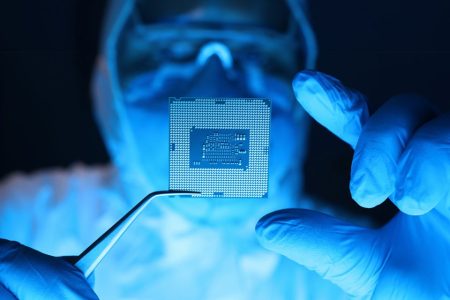

However, the report attributes the Yangtze River Delta’s strong performance to Shanghai and nearby Suzhou’s complementary, comprehensive supply chains: from chip design and manufacturing to high-end equipment. Shanghai’s deep capital market is able to support long-cycle tech startups.

Indeed, Shanghai tops the national ranking with 18 such firms, ahead of Beijing (17), Suzhou (eight), Shenzhen (seven), and Guangzhou and Nanjing (six each).

The pre-unicorns listed in the report span industries including integrated circuits, bio-manufacturing, autonomous driving, new energy, artificial intelligence (AI), robotics and commercial aerospace. Integrated-circuit companies dominated, with 36 firms worth just under a combined US$24.9 billion, while the 14 bio-manufacturing companies accounted for another US$9.9 billion in value.