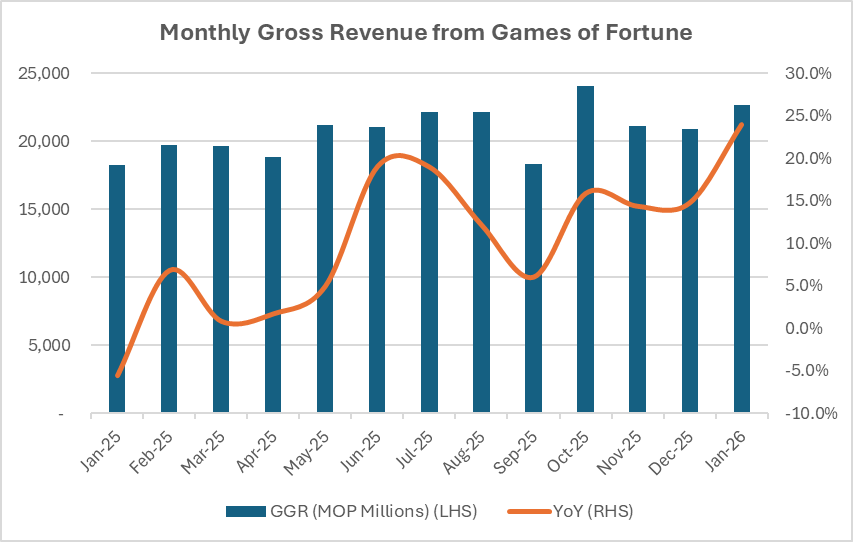

Macao’s gross gaming revenue (GGR) rose 24 percent in January, building on last year’s 9.1 percent gain. Last month’s 22.6 billion patacas (US$2.8 billion) beat analyst expectations, representing the highest reading since October, and comes as the six concessionaires prepare to release their quarterly results.

The better than expected start arrives on the heels of Las Vegas Sands, the controlling shareholder of Sands China, effectively kicking off earnings season last week when the New York-listed company presented figures for its Asian operations, offering an early glimpse into the market landscape.

Revenue growth for the group’s Macao properties rose 16 percent to $2.1 billion over the final quarter, matching the 15 percent GGR growth across this industry, though its earnings before interest, taxes, depreciation, and amortisation (EBITDA) climbed just 6 percent to $608 million, falling slightly behind consensus estimates.

[See more: Gaming revenues topped 247 billion patacas in 2025. Here’s what to expect going into 2026]

Despite an anticipated pickup in market share, the share price for the Hong Kong-listed subsidiary was down about a tenth when trading reopened in Asia, pulling other Macao gaming names lower. Due to its size, Sands China is often viewed as a bellwether for the sector, raising concerns that fellow Macao operators might also report higher expenses and player investment costs when their results are published.

Along with Sands China, CLSA investment analyst Jeffrey Kiang foresees Galaxy Entertainment and MGM China reporting better market share numbers on a year-on-year basis, in part aided by the closure of satellite casinos and increased promotional spending.

Divided on dividends

Besides cost controls, investors will be homing in on cash flows and dividend payouts this quarter, Kiang tells The Bay, noting fewer regional investment opportunities, including the now shelved Thailand entertainment bill, could redeploy capital to shareholders.

A potential move by MGM China to raise its dividend payout would be interpreted as a minority shareholder-friendly shift following the company’s sudden announcement to hike royalty payments to parent MGM Resorts International from 1.75 percent to 3.5 percent, which sparked a heavy sell-off across the sector in late December.

[See more: Macao gaming stocks sold off sharply on Monday. Here’s why]

Kiang points out that MGM China’s balance sheet has room to increase its payout ratio from 50 to 55 percent of net profit, moving it closer to the 58 percent Galaxy Entertainment paid out in the first half of last year.

Supported by expectations that its Phase 4 capex cycle will peak in 2026, Kiang projects Galaxy Entertainment’s dividend payout to reach 60 percent of its full-year net profit. The group reported $4.5 billion in cash as of the third quarter, according to the analyst’s note.

For Sands China, CLSA assumes a final dividend of HK$0.75 per share, implying a full dividend payout ratio of 84 percent from its annual free cash flow to equity holders. For Wynn Macau, the final dividend should remain the same as its interim dividend of HK$0.1875 per share.

According to the broker’s estimates, the sector’s weighted average dividend yield is 5.6 percent with individual stocks paying out 3.7 to 7.9 percent this year.

Valuation and buybacks

Valuations for Macao gaming stocks remain below historical averages, with CLSA pricing the sector at a forward enterprise value to EBITDA multiple of 9.8x, noting that a margin recovery or evidence of promotional stability could prompt a sector re-rating.

The investment house is projecting gaming revenues to expand 5 percent to 260 billion patacas this year after surpassing 247 billion patacas in 2025, the industry’s largest gaming intake since 2019. Stocks responded to the industry figure, with Bloomberg’s gaming index returning 11 percent last year, its first annual gain in three years.

Market momentum appears unabated. Tourism arrivals continue to climb while an appreciating yuan benefits mainland tourists who account for more than 70 percent of those coming into Macao.

[See more: Tourism officials report full-year visitor arrival figures for 2025]

“We are seeing a surge in investors’ interest in Macao’s gaming this quarter, probably the highest level since 2018,” comments Ben Lee, IGamiX managing partner, in conversation with The Bay.

Besides investors, corporate interest remains visible as well. Over the fourth quarter, Las Vegas Sands spent HK$518 million to purchase 25 million shares of Sands China common stock, increasing its ownership to 74.8 percent as of December 31, 2025.

During the earnings call, Patrick Dumont, president and chief operating officer of Las Vegas Sands mentioned that given market dynamics and growing cash flows, he wouldn’t be surprised that there was a preference for the Sands China board to approve a dividend increase, benefiting shareholders including the parent.

In 2025, Las Vegas Sands repurchased approximately $1.6 billion of its own shares, bringing total buybacks since the fourth quarter of 2023 to more than $4.5 billion. Large-scale buybacks are often seen as a signal that management views its stock as undervalued and is confident in the company’s outlook. For shareholders, share buybacks are also accretive to earnings per share (EPS), since repurchases reduce the number of shares outstanding.