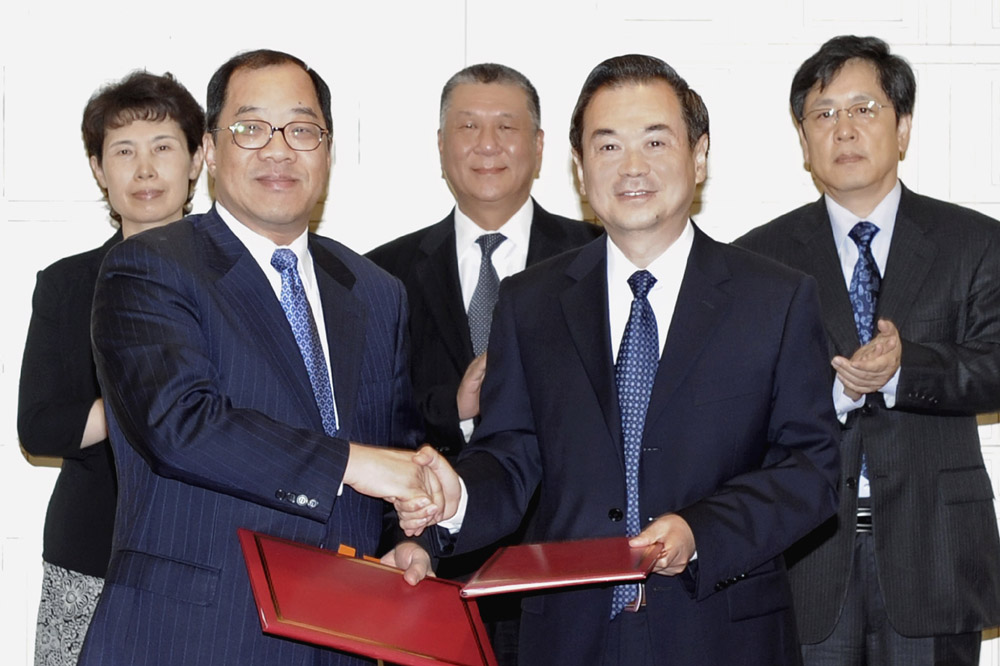

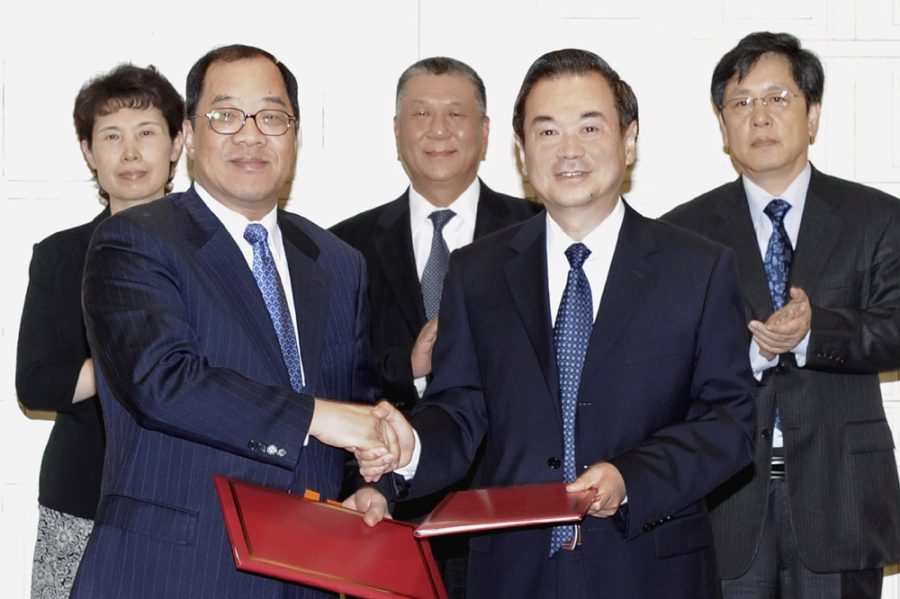

Macau, China, 17 Jul – The governments of Macau and mainland China on Wednesday signed a protocol in Macau to change an agreement that has been in place since 2003 to prevent double taxation and tax evasion.

The new protocol, which goes into effect on 1 January, 2010, plans to reduce taxes for Macau residents in mainland China, according to a statement released by the Office of the Macau Secretary for Economy and Finance.

The original agreement, signed six years ago, defines measures to prevent the two governments from simultaneously taxing the same income earned by residents from Macau and mainland China.

Among the Special Administrative Region taxes that are referred to in the agreement are the ones applied to professional income, additional income and urban properties, as well as the stamp duties applied to the taxes.

In regards to mainland China, the protocol refers to taxes applied to income earned by individuals, businesses with foreign investment and foreign businesses, and also applies to local income tax.

The agreement also offers reciprocal tax benefits for income from real estate, associated businesses, dividends, interest, royalties, one-time gains, pensions, state remunerations, teachers and researchers, students and interns, among others.

The agreement was signed by Wang Li, the deputy director of the Taxation Administration of the People’s Republic of China, and Francis Tam Pak Yuen, Macau’s Secretary for Economy and Finance.

(MacauNews)