China’s consumer price index (CPI), a key gauge of inflation, edged up 0.1 percent year-on-year last month, according to data released by the National Bureau of Statistics on Wednesday.

This modest increase marks the first time in five months that consumer prices have risen, the South China Morning Post reports, though it still underscores the persistent challenge of weak domestic demand in the nation’s economy, further complicated by an ongoing trade dispute with the United States.

The June CPI figure surpassed forecasts, which anticipated a 0.03 percent drop, based on a poll of Chinese economists conducted by financial data provider Wind. In May, the CPI had seen a 0.1 percent year-on-year decline.

Dong Lijuan, a senior statistician at the National Bureau of Statistics, told the Post that “Policies to expand domestic demand and boost consumption continued to show results in June.”

The country is currently grappling with persistent deflationary pressures stemming from a combination of sluggish domestic consumption and industrial oversupply. The trade war is further impeding manufacturers’ ability to clear excess inventory.

In response, the central government has initiated a series of measures aimed at stimulating consumption, including a substantial trade-in programme offering subsidies for vehicles, household appliances, and other goods. However, this scheme has recently exhibited signs of losing momentum, and deflation remains a significant concern for the authorities.

Last week, China’s top leadership addressed the issue, vowing to tackle “disorderly low-price competition” during a meeting of the Central Financial and Economic Affairs Commission, the Communist Party’s highest economic policymaking body.

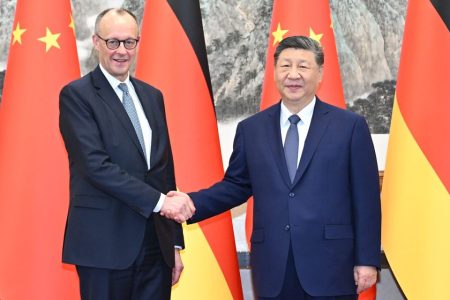

[See more: President Xi offers reassurances on China’s economy for 2025]

Analysts, however, contend that the root cause of China’s deflation problem is ultimately weak demand. They have advocated for more assertive policies to boost household incomes, stabilise the job market, and improve corporate balance sheets.

“I think it is too early to call the end of deflation at this stage. The momentum in the property sector is still weakening,” stated Zhang Zhiwei, president and chief economist at Pinpoint Asset Management. He told the Post that the government’s campaign against “disorderly low-price competition” is still in its nascent stages, with the specific measures to prevent firms from cutting prices amidst weak consumer demand yet to be clarified.

Breaking down the June figures, consumer goods prices saw a 0.2 per cent year-on-year decrease, while service prices rose by 0.5 per cent, according to the statistics bureau. Food prices declined by 0.3 per cent from the previous year. Conversely, prices for other goods and services increased by 8.1 per cent, clothing by 1.6 per cent, and housing prices by 0.1 per cent.

Core inflation, which excludes volatile food and energy prices, recorded a 0.7 per cent year-on-year increase last month, reaching its highest level in 14 months, the Post reported.

In contrast, China’s producer price index (PPI), which tracks factory gate prices, continued its downward trend, falling by 3.6 per cent year-on-year in June, marking its 33rd consecutive month of decline.

Huang Zichun, a China economist at Capital Economics, remarked in a note on Wednesday that the improvement in the CPI was largely attributable to the effect of the consumer goods trade-in programme, but cautioned that this boost is likely to diminish soon.

“We expect demand to weaken later this year, as exports slow and the boost from fiscal support diminishes,” Huang stated. “With goods supply continuing to outpace demand, persistent overcapacity means price wars among manufacturers are likely to continue, despite government efforts to address the problem.”

This article was drafted by AI before being reviewed by an editor.